The BEST tips to CALCULATE VAT

There are some concepts that generally bring us upside down, especially if you are self-employed or need to do any type of invoice, you may be wondering how to calculate VAT correctly. If you have doubts and you want to learn how to bill correctly, applying this tax as it should, do not stop reading the following article. Next, in a PROFESSOR we bring you the tips for calculating VAT that will allow you to shed light and better understand how this tax works. Take note!

What is VAT.

To know how to calculate VATproperly, you must first understand what it is about. VAT is an indirect tax that is applied to the consumption of products and services. It is an indirect tax since it is not received directly by the Tax Agency, but by the provider or seller of said product and / or service, who will be in charge of declaring it to the Treasury, either monthly or quarterly.

VAT rates in Spain

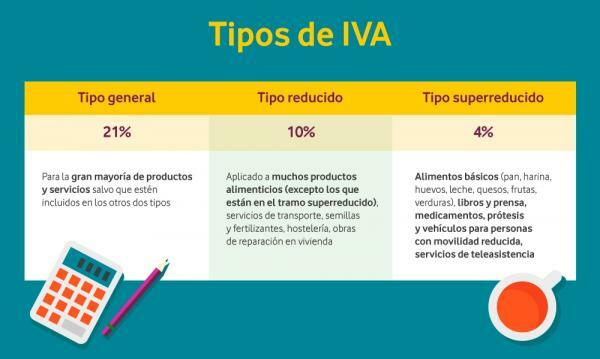

In Spain there are different types of VAT that will vary depending on the product or service offered for sale. In summary, we are talking about three different types of VAT:

- general: is the one that is applied by default to any product or service and is encrypted at 21%.

- Reduced: it is 10% and is awarded to those products or services considered necessary, such as food. Likewise, other categories to which this type of VAT is applied are repair services, hospitality or passenger transport, among others.

- Super reduced: 4% VAT is applied to essential products or services (bread, milk, eggs, fruits, books, newspapers, medicines…).

Image: Vodafone

Calculate VAT: everything you need to know.

Now that you know what VAT is and what VAT rates are in Spain, you have to take action and resolve the question that assails you from the beginning: how to calculate VAT. It is a simple operation that you can solve if you make a simple formula.

To calculate the VAT that you must impose on a product or service, you must establish the price of the product and then apply the corresponding VAT percentage. We explain it to you with a practical example.

- The product costs € 10

- A general VAT of 21% must be applied.

- Make a rule of three: multiply the € 10 by 21% VAT and divide by 100. Or pass the VAT directly to decimals and multiply the amount by 0.21.

- In this case: 10 x 0.21 = 2.1.

- You must add € 2.1 to the initial price. In this way, you will have added the correct VAT and you will get the final price, which in this case is € 12.1.

In case you do not have a calculator at hand or time to perform this formula, you can use the VAT calculators available online. In them you just have to enter the price and the amount of VAT applied to make the calculation automatically.

If you are clear about the VAT calculation formula, you will be able to carry out this operation quickly, easily and very efficiently.

Image: Opcionis

If you want to read more articles similar to Tips for calculating VAT, we recommend that you enter our category of Economy.